Market Watch: From Beer To Gas – Tariffs On Consumption

A week after he first announced his plan for foreign trade, President Donald Trump signed a bill on Thursday that will enact tariffs on aluminum and steel imports at 10 percent and 25 percent, respectively. Consumers might be wondering why this new law is a point of contention amongst government officials and American businesses. Navigating through these discussions, we can better understand what these tariffs mean for the American economy.

Chief Economic Adviser Gary Cohn attempted to dissuade the Trump Administration from signing off on the tariffs by explaining their shortfalls, before ultimately resigning this past Tuesday when his advice went unheeded. A former executive at Goldman Sachs and credited with getting tax reform to pass, Cohn’s presence in the administration was very influential to stock investors have been viewing the financial markets with trepidation after the president’s first announcement on the matter. Since Cohn’s departure, however, investors have become increasingly interested in the direction of the administration’s economic policies. Senate Majority Leader Mitch McConnell has also shared concerns over the tariffs on free-trade, commenting that many GOP members are worried about the implications of these tariffs on recent economic growth.

To explain the basics behind these tariffs people are worried about, they are levies similar to taxes that are applied to the value of foreign purchases. On one hand, these tariffs can aide domestic businesses with foreign competition by making these metals more expensive to buy for U.S. consumers. On the other hand, businesses whose goods and services rely on steel and aluminum will have to pay more for the metals. Some companies can take on the extra cost without losing value in their production, but others will have to cut back on costs, such as labor, to offset these levies.

Aluminum imports have a less severe tariff at 10 percent and few have argued its benefit to American businesses in terms of competition. Head of the Aluminum Association Heidi Brock argued that imposing the tariff on China could ease competition in aluminum, for which global prices have decreased due to China’s overproduction of the good. However, Brock also warns the tariff will impact the 712,000 employees that work in aluminum production and related businesses as 60 percent of the aluminum supply come from imports. An example of this impact could be seen in the beer industry as reports show the tariff would further complicate the challenges smaller breweries face.

In recent years the industry has seen an increasing number of competitors enter, with most of the breweries selling beer in cans due to its affordability. However, this increase in sellers has caused a rise in costs for producing beer and made it difficult to increase sale prices. Well-known beer brands have market advantage and can afford the aluminum tariff. In contrast, small brewers like Oskar Blues and Fullsteam will likely have to implement layoffs and change their business models to offset its cost to their production and maintain competition. Oskar Blues Marketing Director Chad Melis estimated the tariff will cost them an additional $400,000 each year – equal to one-percent of their revenue from last year. Fullsteam Founder Sean Wilson commented that the North Carolina-based brewery would have to find cheaper alternatives to their local producers to keep up with expected cost increases.

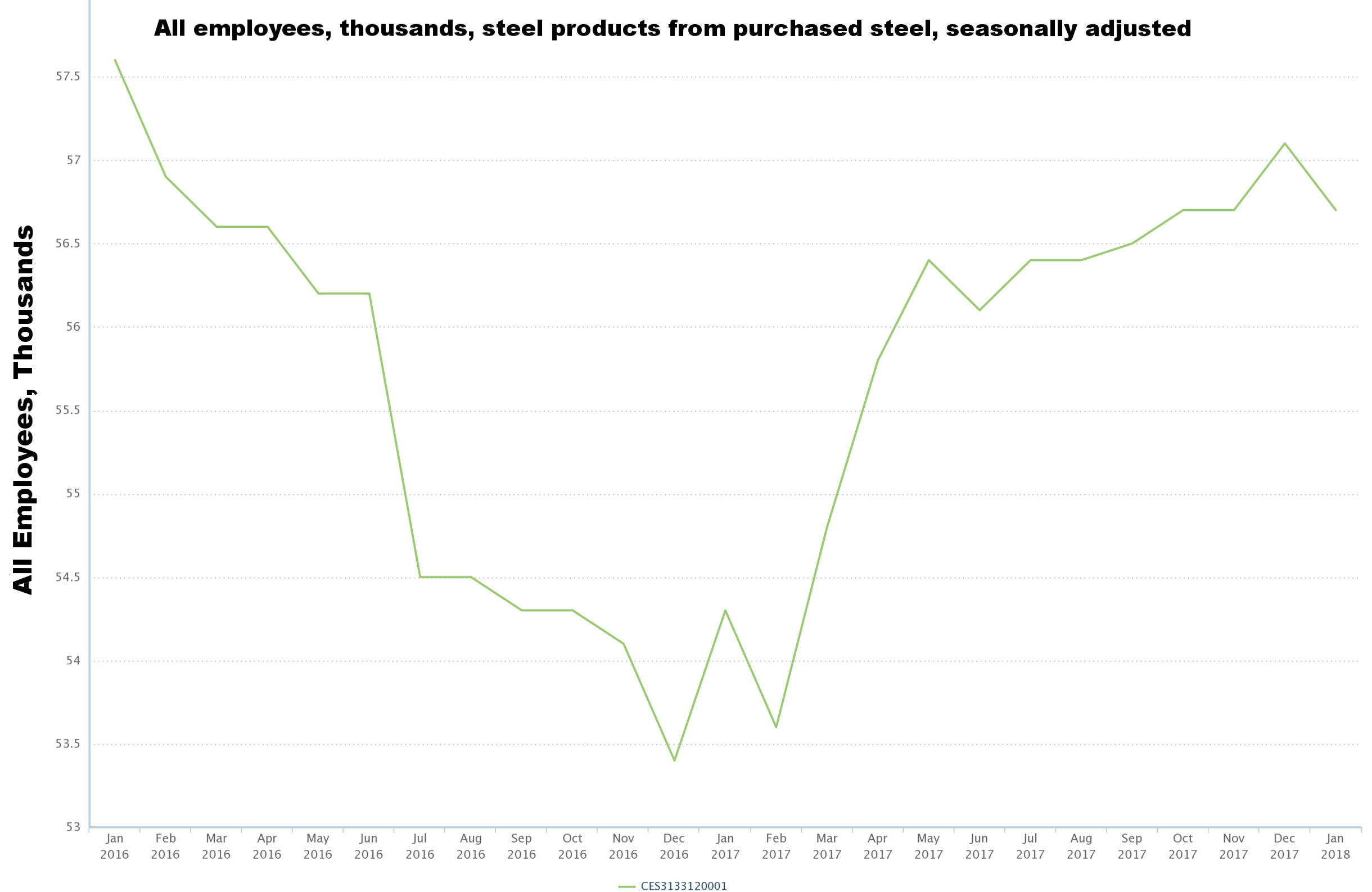

The CEO of TimkenSteel Tim Timken has also made similar arguments on the benefits of imposing tariffs on China regarding steel imports. In the last few years, the company has been forced to lay-off some of their workers, hiring less back only recently, due to China’s influence over lower global prices on steel. Timken uses the Bush administration's 30 percent tariff on steel imports as an example of why the markets won’t face much damage since there were no changes in the unemployment rate or economic growth in 2002. Yet, that tariff was removed within a year at the behest of the U.S. International Trade Commission who reported that companies relying on steel were forced to cut back on production costs. Additionally, one-fifth of these companies resolved to offset the tariff by imposing higher prices on consumers.

It appears the 25 percent tariff on steel will lead steel-dependent businesses to make similar decisions along those same lines. In an interview with CNN, CEO of Canary LLC Dan Eberhart says he will have to lay-off around 17 percent, at least 25 to 50, of his employees. Every year, the Denver-based company spends around $10 million on steel imports to fund their oilfield services such as pressure control equipment and wellheads, to name a few. Eberhart also reported that they’ve paid 20 percent more on steel imports since the president’s tariff announcement last week.

This is just one example of challenges the American Petroleum Institute (API) argued would occur with the steel tariff. In addition to the operations like the ones performed by Canary, the API also noted services such as production facilities, liquefied natural gas terminals and petrochemical plants also rely on steel imports and as such the oil and natural gas industry will suffer greater costs from enlisting these services.

However, the tariffs may prove to be less detrimental to the economy than most believe. China is just one of the biggest exporters that the U.S. receive their steel from, with other steel imports coming from Brazil, South Korea, Mexico and Canada. After a series of negotiations leading up to the bill’s signing, the Trump administration has scaled back on the rigidity of the tariffs by exempting Canada and Mexico from them. The president has also extended this flexibility for other allies open to negotiations, naming Australia as an example for another country exempt from the tariffs.

As it stands, there’s evidence from both sides that argue for and against the tariffs. Considering the rise of inflation, an increase in prices could benefit the economy by staying ahead of the inflation rate. Though with wage growth rising slowly, coupled with the potential jobs cuts to related industries, the tariffs on aluminum and steel could make affording those higher prices difficult. For now, all consumers can do is wait patiently on the results of the fiscal stimulus on the economy.