Market Watch: The Education Bubble

Remember the days when things were expensive because they used to be good and not because everyone wanted them? When durable and well-stitched jackets used to be expensive unlike today: when the resale price of the Supreme hoodie is a $1000 while its original price was $130 and cost less than $25 to manufacture.

The mere demand of certain products can drive up their price way above its cost. But can demand only drive up the price of certain commodities in the market or drive up the market itself?

With technological advancements and easily available credit, the world is seeing an exponential growth which is followed by high demand because of a rise in population and purchasing power. The high demand for commodities can drive the price way above its intrinsic value. This is called an economic bubble.

Prices are driven by demand. Higher demand can lead to exponential growth in prices. If the demand continues to sustain, the cost of the commodity will soon surpass the worth of the commodity, leading to hyperinflation of the product- bubble ballooning up. Soon the product becomes so expensive that people stop investing in it, which will lead the bubble to pop eventually.

Remember the 2008 financial crisis?

The housing bubble in the economy grew so big, that when it popped, the entire world went into an economic shock and it cost the US economy $700 billion over the course of a decade. But how did the US economy reach there?

The notion that owning a house to achieve the American dream was drilled in by politicians, the government and policymakers for decades. Tax laws were altered, subsidies were created, new institutions were created to increase the supply of funds available to borrowers. The idea was to base the US economy on a firm base in the real estate market, after the housing crisis of 1982.

Government guarantees were provided to encourage lending to lower-income households that might otherwise have been considered too risky to lend to and thus, denied loans. Congress passed the Community Reinvestment Act (1977-1995) which compelled banks to give loans to low income and minority borrowers, increasing the pool of active borrowers.

The results were as expected. People bought more houses to make their future secure, pouring more money into the housing market. When the demand for a product increases, so does its price. The average cost of a house, rose from $93,400 in 1980 to $119,600 in 2000, after adjusting an average inflation growth rate of 2.4 percent per year.

Market Watch

Houses started becoming expensive, so the government decided to lower loan rates for people with low income, to invest more and keep the market afloat. Everyone who wanted to own a house and they could take a low-interest loan backed by the government irrespective of their ability to pay back or not.

To encourage people into buying more houses, the down payment rates which used to be fixated on 20 percent, were dropped to 3 to 5 percent. So everyone did what they were supposed to, bought a house which they cannot afford because that was the only way to fulfill the American Dream.

Hell broke loose in December 2007 when the easy lenders wanted the money that was promised to them in terms of easy monthly installments (EMI). A booming housing market gave the equity of the house to the owner who didn’t have money to afford the house on his income and couldn't rent it because every Tom, Dick and Harry owned a house now. The housing market, where prices were driven by demand and not by worth, soon became too expensive to afford, despite the easy credit available. When they weren’t able to pay their loans back, the market collapsed and we all know what happened next.

Why are we talking about a decade old financial crisis in 2019, when the economy is stable and booming?

Look around you, do you see a similarity in the 2008 financial crisis and economic sectors that exist today? Let’s educate ourselves.

The annual average rate of increase in tuition at a four-year college is 3.1 percent since 2009, while the median family income in the US saw an increase in 0.8 percent between 2008-17. The cost of attending college has doubled since 1988 while student debt has accumulated to $1.5 trillion in 2019.

Visual Capitalist

The student loan crisis is not unknown to us at this point. In The class of 2018, 69 percent of student took student loans to complete their education and graduated with an average debt of $29,800. Nearly 14 percent of the parents also took up loans to push their kid through college, accumulation $35,600 of debt in the process.

College is getting more expensive, yet more people are applying for a college degree.

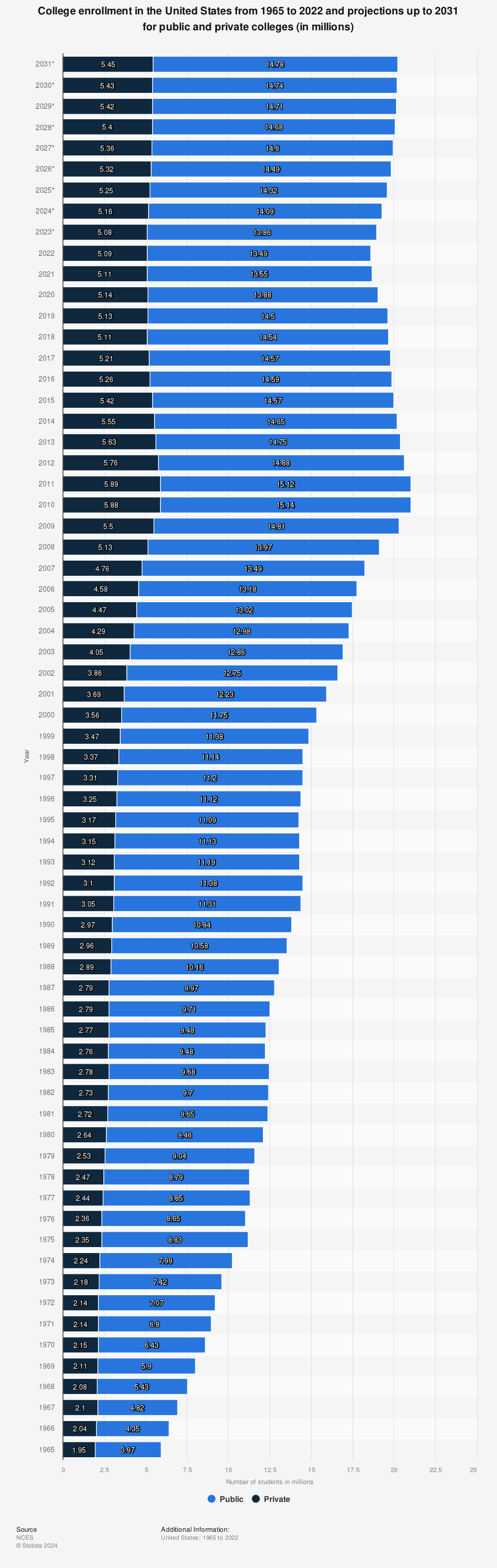

In 2016, about 5.3 million students were enrolled in private colleges and 14.6 million in public colleges. Since 1965, total college enrollment saw an increase of 240 percent, while the US population grew by a mere 50 percent since 1960.

President Lyndon Johnson understood the importance of education and wanted to use education to reduce economic disparity. In 1965, Congress passed the Higher Education Act (HEA) which provided grants and low-interest rate loans to low and middle-class American students.

Over the course of years, different Presidents added funds to HEA and amended it to increase its reach for the general public. In 1978, President Jimmy Carter, a patron of education and environment amended the HEA of 1965 into the Pell Grant and increased the cap eligibility for families with incomes up to $250,000 for the grant.

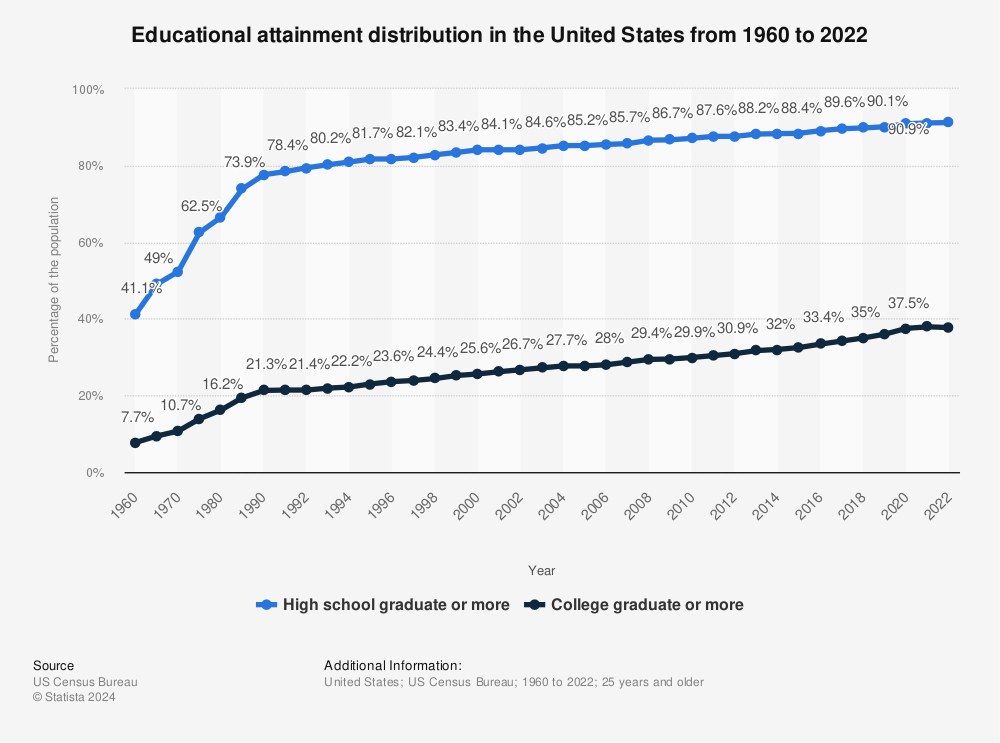

People started applying more into universities and the demand for education sprung up. Almost 35 percent of Americans were college graduates in 2018, as compared to a mere seven percent college graduates in 1960.

Then came the Taxpayers revolt and Reaganomics. Taxpayers didn’t like how their tax money was being used to subsidize the education cost for someone else. And since then, Presidents started cutting short the Pell Grant funds to appease a sect of voters.

But the doors towards higher education were already open by now and college graduates understood the value of education and tried to instill the same in their kids.

State funding kept falling, leaving universities with less money and more applicants. Overall state funding for public two- and four-year colleges in the 2017 school year, was nearly $9 billion below its 2008 level, after adjusting for inflation.

Higher demand for a degree has also driven up the cost of attending college. The average price of an undergraduate degree has risen from $63,000 since 1987, or 161 percent, after adjusting inflation.

So students started taking out more loans to get a highly valuable and expensive college degree. The share of students that took a loan to higher education rose from 50 percent in 2000 to 60 percent in 2012. Not only today did more students started taking up loans but the average student debts also increased from $16,500 in 2000 to nearly $30,000 in 2018.

If people are investing so much money and taking out loans, there must be an outcome that they are looking for. Probably find a stable job with good pay, pay off their creditors and then build a good life with their earning.

Only 57 percent of undergraduates complete their four-year bachelor's degree within six years along with a huge debt which they will pay for half of their adult life.

Unemployment rates for a college graduate in 2018 were 5.4 percent as compared to a 5.3 percent rate in 2008, but the average student debt has increased to $43,000 in 2018 from $23,000 in 2008, after adjusting inflation.

Market Watch

College graduates are finding it difficult to find jobs according to their educational background and end up underemployed. In 2018, 11.1 percent of college graduates were underemployed as compared to 6.9 percent in 2000.

In today’s competitive market, it requires having a college degree even to be considered for a job. According to research conducted by Georgetown University in 2019, it is expected that 65 percent of the jobs will require some college degree by 2020.

So, to be even considered for a job, you need to have a college degree. But the return on the college degree might not be what you were expecting. Average student debt of $30,000 after a bachelor’s degree will stall 36 percent of graduate’s thoughts to save for retirement, while 21 percent won't be able to own a house before they are 35.

Americans are getting less convinced that whether college is actually worth its cost or not. In 2013, 53 percent said that college was worth its cost as compared to 49 percent in 2017.

The average loan payment of student debt for an American graduate is $393. Nearly 40 percent of borrowers are expected to default on their student loans by 2023.

Rising college debt and the inability to absorb college graduates in the working market will discourage students to even enroll in colleges. Soon, the cost of attending college will exceed way beyond its worth and people will look for alternatives for education like apprenticeship programs and Income Shared Agreements.

Philanthropists like Peter Thiel, the co-founder of PayPal, has very interesting views on the education bubble and has been trying to bring the issue to light for quite some time.

Just like the housing bubble, the education bubble was created with the easy availability of credit and high demand. Inability to return those credits will halt the cash flow and pop the bubble.

Currently, the student debt accounts for one-third of the US government assets and if not controlled, might pop just like it did in the 2008 housing market. The number of debtors is rising but their ability to pay back the debt is diminishing.